China and India in Africa’s Fertilizer Race – Trade, Strategy, and Influence

China and India in Africa’s Fertilizer Race – Trade, Strategy, and Influence

Introduction: Two Giants, One Continent

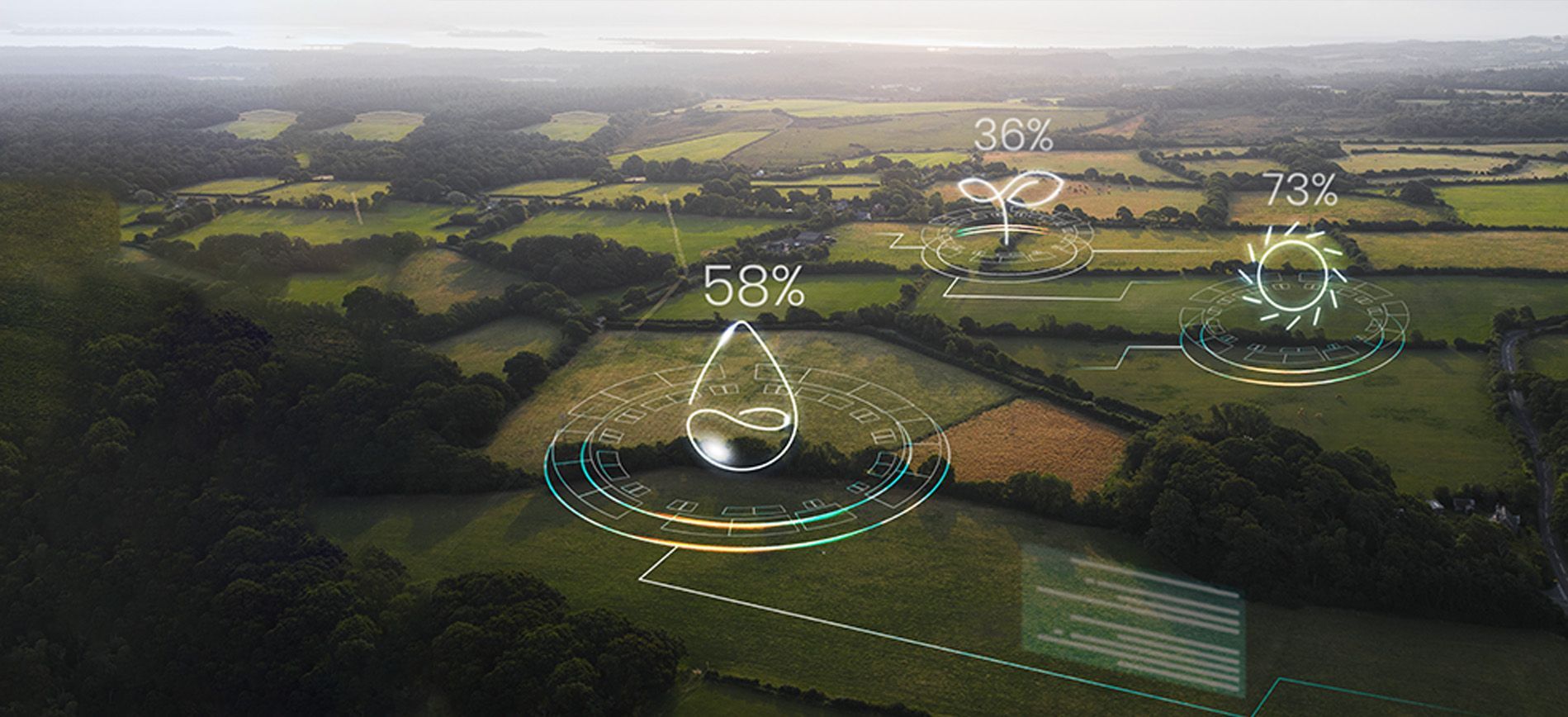

Africa’s agricultural transformation is attracting the world’s most considerable fertilizer powers—China and India, each bringing unique strategies to expand their influence. With over 60% of the world’s uncultivated arable land and rapidly rising fertilizer demand, Africa has become a competitive stage for fertilizer diplomacy, market expansion, and soft power projection.

In this blog, we compare how China and India are shaping Africa’s fertilizer future through trade routes, strategic investments, joint ventures, and technology transfers—and what this means for local suppliers, governments, and development partners.

1. Why Africa Matters to China and India

- Market Potential: Africa’s fertilizer use is still far below global averages—under 25 kg/ha compared to the world average of 135 kg/ha.

- Geopolitical Positioning: Both nations see fertilizer partnerships as part of broader trade, energy, and agricultural diplomacy in Africa.

- Food Security: Africa is a testing ground for sustainable agriculture solutions that can be re-exported to domestic and third-country markets.

2. China’s Strategy: Infrastructure and Bulk Supply

China’s fertilizer expansion in Africa is built on:

- Export Power: China is one of the top global producers of urea, DAP, MAP, and NPKs, supplying millions of tons annually to African markets.

- Belt and Road (BRI) Projects: Integrated trade corridors (ports, railways, logistics parks) that support fertilizer exports and infrastructure-led agriculture.

- State-Supported Companies: Major firms like

Sinochem,

CNAMPGC, and

Wengfu operate across Africa with government backing.

Examples of Influence:

- Tanzania & Mozambique: Bulk fertilizer exports and infrastructure investment at port terminals.

- Zimbabwe & Ethiopia: Technical support and concessional deals on fertilizers as part of broader bilateral packages.

- Morocco: Joint projects with Chinese firms on phosphate processing and blending initiatives.

3. India’s Strategy: Innovation and Farmer-Centric Models

India, though a large importer of fertilizer itself, has become an agile exporter and knowledge partner in Africa by focusing on:

- Nano-urea and Smart Fertilizers: Through IFFCO and other public-private players, India promotes low-volume, high-efficiency inputs suited for Africa’s smallholder farmers.

- Capacity Building: Indian government-funded training programs, agronomic support, and East and West Africa soil mapping.

- Private Sector Exports: Indian companies export prilled urea, NPK, and micronutrients to Kenya, Nigeria, and Ghana.

Examples of Influence:

- Kenya & Ghana: Strategic government-to-government deals for Indian fertilizer shipments.

- Uganda: Pilot programs for nano-urea distribution via mobile apps and extension services.

- Togo & Senegal: Indian involvement in blending facilities and agri-financing partnerships.

4. Key Differences in Approach

| Area | China | India |

|---|---|---|

| Fertilizer Type | Bulk DAP, urea, NPK | Nano-urea, prilled urea, micronutrients |

| Mode of Entry | Infrastructure-led, long-term investment | Tech-led, farmer-centric, training-heavy |

| Focus Countries | Angola, Ethiopia, Tanzania, Zimbabwe | Nigeria, Kenya, Ghana, Senegal |

| Partners | State-owned enterprises | Co-operatives (e.g., IFFCO), private exporters |

| Soft Power Tool | BRI & concessional finance | Technical assistance & education |

5. What This Means for Africa’s Fertilizer Market

Opportunities for African Governments:

- Leverage both models: Use Chinese infrastructure and Indian training to develop a hybrid fertilizer ecosystem.

- Encourage competition to reduce prices and improve product variety.

- Attract foreign investment in

local blending,

storage, and

distribution hubs.

Opportunities for Local Distributors & Blenders:

- Source bulk materials from Chinese suppliers at scale.

- Collaborate with Indian firms for

R&D,

field trials, and

nano-fertilizer supply chains.

Opportunities for Development Agencies:

- Support regulatory harmonization under AfCFTA to ease cross-border fertilizer flows.

- Back digital and agronomic tools imported from both nations.

Conclusion: A New Fertilizer Geopolitics

India and China are not just exporting fertilizers to Africa—they are exporting strategies. China bets on volume and infrastructure; India bets on efficiency and training. Both models can coexist, complement, or compete—but what matters most is that Africa harnesses this competition to build a more resilient, localized, and sustainable fertilizer economy.

The message is clear for suppliers, distributors, and governments: choose partners wisely, negotiate strategically, and build locally.