Africa’s Fertilizer Blending Boom – How Local Formulation is Reshaping the Market

Africa’s Fertilizer Blending Boom –

How Local Formulation is Reshaping the Market

Introduction: From Imports to Indigenous Innovation

Africa’s fertilizer sector is undergoing a quiet revolution. Instead of importing standardized blends, countries like Nigeria, Ethiopia, and Senegal are now investing heavily in local fertilizer blending plants. This shift is reshaping how nutrients are delivered to farmers and redefining how global suppliers of urea, NPK components, and micronutrients engage with African markets.

The rise of blending hubs is transforming Africa from a passive importer into an active fertilizer formulator—a development driven by soil mapping data, government-backed programs, and demand for crop-specific, climate-smart solutions.

1. What’s Fueling Africa’s Blending Boom?

Several strategic forces are driving the establishment of domestic fertilizer blending plants across Africa:

- Soil Health Reports: Years of data collection reveal region-specific nutrient deficiencies (e.g., low phosphorus in West Africa, sulfur in East Africa).

- Government Policy Support: Countries are offering incentives to reduce dependency on imported finished blends.

- Rising Demand for Customization: Farmers now seek fertilizers tailored to specific crops and climates.

- Intra-African Trade Aspirations: The African Continental Free Trade Area (AfCFTA) supports localized production and regional trade.

2. Case Study: Nigeria – A Blending Powerhouse

Nigeria has emerged as the largest fertilizer blending market in Sub-Saharan Africa, thanks to initiatives like the Presidential Fertilizer Initiative (PFI).

- Over 70 registered blenders across the country.

- Primary input strategy: Import urea, DAP, and MOP in bulk; blend locally into crop-specific NPKs.

- 2025 Outlook: Nigeria targets 2.5 million MT/year of domestically blended NPK.

Opportunities for Suppliers:

- Bulk supply of granular urea and DAP.

- Contract manufacturing partnerships with local blenders.

- Delivery of micronutrients (e.g., boron, zinc) for cocoa, cassava, and maize blends.

3. Case Study: Ethiopia – Mapping Soil to Markets

Ethiopia’s Ministry of Agriculture, in partnership with the Ethiopian Agricultural Transformation Institute (ATI), has pioneered a soil-based fertilizer strategy supported by:

- Four operational NPK blending plants, with more in development.

- Site-specific fertilizer formulas for teff, maize, barley, and wheat.

- Support from development partners like IFDC, AGRA, and the World Bank.

Market Signals:

- High demand for customized sulfur, zinc, and boron additives.

- Potential for suppliers to partner in capacity building and technical upgrades of blending facilities.

4. Case Study: Senegal – Private Sector Rising

Private sector players such as Agrifocus and OCP Africa are leading Senegal's fertilizer blending journey. They are building regional hubs to serve Senegal, Mali, and Guinea.

Key insights:

- Port of Dakar supports bulk importation and bagging.

- Target crops include groundnuts, cotton, and rice.

- Local governments support

public-private agreements for rural distribution and extension education.

Supplier Opportunities:

- Long-term supply contracts for base nutrients.

- Joint ventures in blending, warehousing, and inland transport.

5. Strategic Shifts for Global Suppliers

The rise of blending plants doesn’t mean reduced opportunity for exporters—it means changing the game. Here’s how:

- From Finished to Raw: Sell base products (urea, DAP, MOP) instead of finished NPK blends.

- Collaborate, Don’t Compete: Partner with local blenders and offer technical or digital tools.

- Invest in Education: Supply not just nutrients, but training on dosage, timing, and mixing ratios.

6. Looking Ahead – The Next Fertilizer Frontier

As Africa’s blending capacity matures, we can expect:

- Standardized regional blends for key crops under AfCFTA.

- Greater adoption of micronutrient-enhanced fertilizers for export crops.

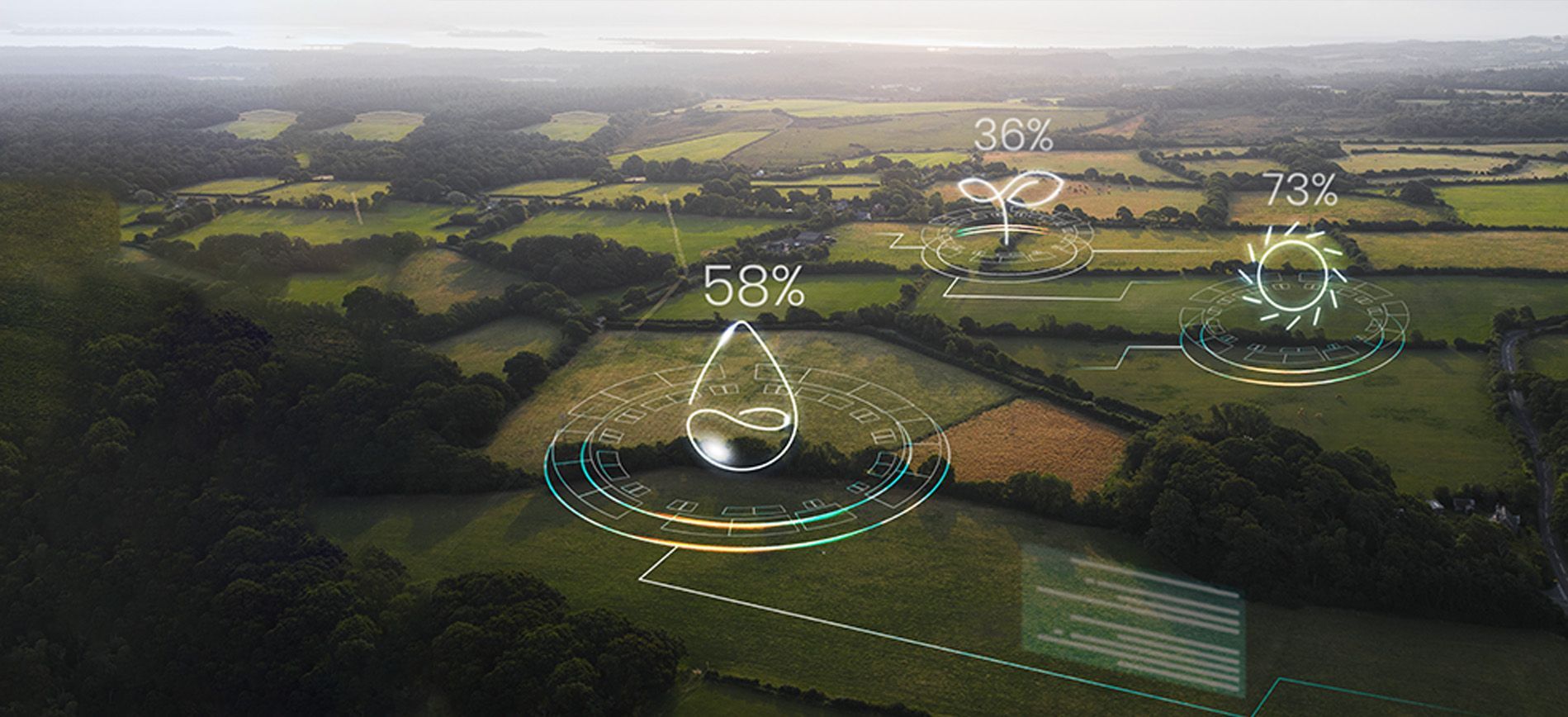

- Digital blending platforms and AI-assisted formulation based on local yield and weather data.

Conclusion: Blending is the Future of Fertilizer in Africa

Africa’s fertilizer market is shifting from passive consumption to active formulation. For suppliers of granular urea, DAP, micronutrients, and specialty additives, the time to engage is now. By integrating into this emerging ecosystem of soil-smart, crop-specific, and locally managed blending plants, suppliers can increase volume and create long-term, sustainable partnerships that grow with Africa’s agricultural transformation.